Spend More Time With Your Money | The King’s Cash | Session 4

Series: The King’s Cash | Session 4

Text: Proverbs 21:5

Slow and steady wins the financial race.

Proverbs 21:5 highlights the wisdom of patience and careful planning. Allan contrasts impulsive spending with steady, thoughtful stewardship, showing how diligence—rather than haste—leads to long-term financial health. Practical habits like budgeting, tracking spending, and avoiding “get rich quick” shortcuts form the heart of this teaching.

Here’s a thought: Albert Barnes observed, “Undue hurry is as fatal to success as undue procrastination.”

Watch “The Turtle and the Hare” fable

I have observed there are two basic groups of people when it comes to money – savers and spenders. Scott and Bethany Palmer, however, identify five money personalities:

Saver

Spender

Risk Taker

Security Seeker

Flyer

Each one has their strengths and their weaknesses. By their assessment my Primary Money Personality is Risk Taker and my Secondary Money Personality is Saver.

King Solomon, one of the wealthiest men to have ever lived, writes in Proverbs 21:5, “The plans of the diligent lead to profit as surely as haste leads to poverty.” NIV

There are two kinds of spenders:

Patient

Impatient

Patient

Good things come to those who wait. As an old Chinese proverb says, “If you want pretty nurse, you must be patient.”

The plans, thoughts and imagination of the diligent lead to profit, advantage, abundance, plenty and prosperity.

The Hebrew word translated as “diligent” can also be translated as “threshing sledge”, an ancient farm implement as pictured here. Threshing sledge or threshing board on its side, with the sharp metal or rock teeth exposed on the bottom:

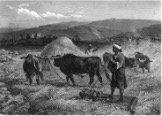

Threshing sledge in operation:

The operator would stand on this sled-like wooden structure and was pulled by a team of oxen or donkeys over grains spread on the threshing floor, thus separating the grain from the straw. Isn’t it interesting that a diligent person is likened unto a threshing sledge? Translating this image from an ancient agricultural society to ours today I can picture someone who works hard and who works smart. There was no shortcut to threshing grain 3,000 years ago but the results were good. Such is the diligent one who takes time to consider what to do with money.

I like the way Eugene Peterson translates Proverbs 21:5 in The Message, “Careful planning puts you ahead in the long run; hurry and scurry puts you further behind.”

Jesus points to the importance of “counting the cost” in Luke 14:25-33:

25 Large crowds were traveling with Jesus, and turning to them he said: 26 "If anyone comes to me and does not hate his father and mother, his wife and children, his brothers and sisters — yes, even his own life — he cannot be my disciple. 27 And anyone who does not carry his cross and follow me cannot be my disciple. 28 "Suppose one of you wants to build a tower. Will he not first sit down and estimate the cost to see if he has enough money to complete it? 29 For if he lays the foundation and is not able to finish it, everyone who sees it will ridicule him, 30 saying, 'This fellow began to build and was not able to finish.' 31 "Or suppose a king is about to go to war against another king. Will he not first sit down and consider whether he is able with ten thousand men to oppose the one coming against him with twenty thousand? 32 If he is not able, he will send a delegation while the other is still a long way off and will ask for terms of peace. 33 In the same way, any of you who does not give up everything he has cannot be my disciple. NIV

This principle of “counting the cost” applies to following Christ and to watching where you spend your money.

Ralph Wardlaw (1779-1853) concluded:

Diligence, while it is opposed to laziness, is opposed also to rashness - to premature and inconsiderate haste. The diligent man first plans and then acts. He proceeds thoughtfully and systematically. Diligence can effect little, unless accompanied with careful forethought. Diligence means steady perseverance in execution. The projects of the attentive, plodding, persevering man, who begins in earnest and goes on to the end in earnest, prepared for difficulties, are those that promise to produce, and generally do produce, a favourable result.

King Solomon says it this way in Proverbs 28:19, “He who works his land will have abundant food, but the one who chases fantasies will have his fill of poverty.” NIV

As my father-in-law would say, “Measure twice cut once.” I have watched people who make financial progress and each one has given careful thought about where their money is going. Do you have any idea how you are spending your money? If no, here is a practical exercise: write down every penny (or nickel) you spend for one month.

There are two kinds of spenders:

Patient

Impatient

Haste or being in a hurry leads to poverty, lack or need.

Albert Barnes comments on Proverbs 21:5, “Undue hurry is as fatal to success as undue procrastination.”

“Alice's Adventures in Wonderland” author Lewis Carroll (1832-1898) moaned, “The hurrier I go, the behinder I get.”

Beware of “get rich quick schemes”. I am ashamed to say that I was burnt by an investment opportunity that, looking back on it, was too good to be true.

Solomon talks about growing your money slowly but surely in Proverbs 13:11, “Dishonest money dwindles away, but he who gathers money little by little makes it grow.” NIV

The Proverbs and the Bible warn against the dangers of laziness many times. Hastiness and laziness are twins, because they are both born out of a lack of self-control.

Would you rather eat a meal cooked in an oven or a microwave? I admit I am not the greatest of cooks. There are occasions when I fire up the barbecue but I confess that I use our microwave oven more frequently. Sometimes when Brenda is away I will pull a TV dinner out of the freezer. I have noticed that it takes longer but even a TV dinner tastes better when it is cooked in the oven than when it is cooked in the microwave oven.

A lot of people don’t spend much time with their money because it burns a hole in their pockets. Budgeting is essential but it doesn’t need to be complicated.

Devise a method that works for you (e.g. envelope system). Spend less than you make and you will never be short of money. Shop around. Use coupons.

You probably already knew this but people who shop for groceries with a list tend to buy less than those who are “listless”. My wife, Brenda, does the vast majority of grocery shopping in our household but I have shopped with her occasionally. I confess that tasty items can grab my attention and easily distract me – especially those in the snack aisle. More than once Brenda has said to me, “I better leave you at home next time because we end up buying more when you come along.”

Buy good used items rather than brand new all the time. A number of years ago I bought a pair of dress shoes in a shoe store in a mall for about $70. I did not find them overly comfortable but a short time later I came across a pair of dress shoes for less than $10. I still prefer them to the more expensive shoes.

When was the last time you were in a thrift store? Would you be embarrassed to be seen in a thrift store?

If you tend to spend more than you should perhaps you should consider plastic surgery. Cutting up your credit cards could be the step you can take toward spending more time with your money. A less dramatic step would be to remove them from your wallet or purse and store them somewhere in your home that makes them less accessible. Some people use a debit card rather than a credit card to avoid overspending and the exorbitant interest for credit card debt.

Paying for consumer items with cash – at least for a season - can really help us to be more aware of where the money is going.

The Lord extends this invitation in Isaiah 55:1-2:

1 Come, all you who are thirsty, come to the waters; and you who have no money, come, buy and eat! Come, buy wine and milk without money and without cost. 2 Why spend money on what is not bread, and your labour on what does not satisfy? Listen, listen to me, and eat what is good, and your soul will delight in the richest of fare. NIV

Some people shop for fun or for something to do. It is amazing how many things I can find in the mall that I “need”. I confess my weaknesses are electronics stores and bookstores. The more time you spend in the stores and at the mall the more money you will spend. If you are a recreational shopper it is time to find another hobby if you want to make financial progress.

Two men were overheard talking in a souvenir shop. Just as one was telling the other that his wife was getting carried away with her shopping, a brief power shortage caused the lights to flicker overhead.

"Ah," he sighed, “That must be her checking out now."Shopping can also be medicational. I knew someone who shopped excessively. Now I realize that she struggled with depression and found that buying new things covered up the pain inside. Much like alcohol or gambling addictions a shopping addiction can stunt your personal growth, strain your marriage and drain you financially.

It is all around us here in Canada but when I visit another country I seem to notice trends and behaviours more readily. I had my eyes opened when we visited the Philippines: we saw people struggling to put food on the table and a roof over their head while they had the latest smartphone, flat screen television and computer.

I have had a number of people say to me with a wistful look in their eyes, “When I win the lottery I will …”

A 2014 Reader’s Digest article reports, “Whether we win $500 million or $1 million, about 70 percent of us lose or spend all our money in five years or less.”

For example, Sharon Tirabassi, a single mother who had been on welfare, cashed a cheque from the Ontario Lottery and Gaming Corporation for $10,569,00.10 (Canadian) in 2004.

She subsequently spent her winnings on a "big house, fancy cars, designer clothes, lavish parties, exotic trips, handouts to family, loans to friends" and in less than a decade she was back riding the bus, working part-time, and living in a rented house."

Fortunately Tirabassi put some of her windfall in trusts for her six children, who can claim the money when they turn 26.

Are you spending more than you are making? Here’s a practical exercise: go on a spending fast, abstaining from buying anything but the bare necessities for one month.

There are two kinds of spenders:

Patient

Impatient

Slow and steady wins the financial race.